XRP Price Prediction: Technical and Fundamental Outlook for 2025

#XRP

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

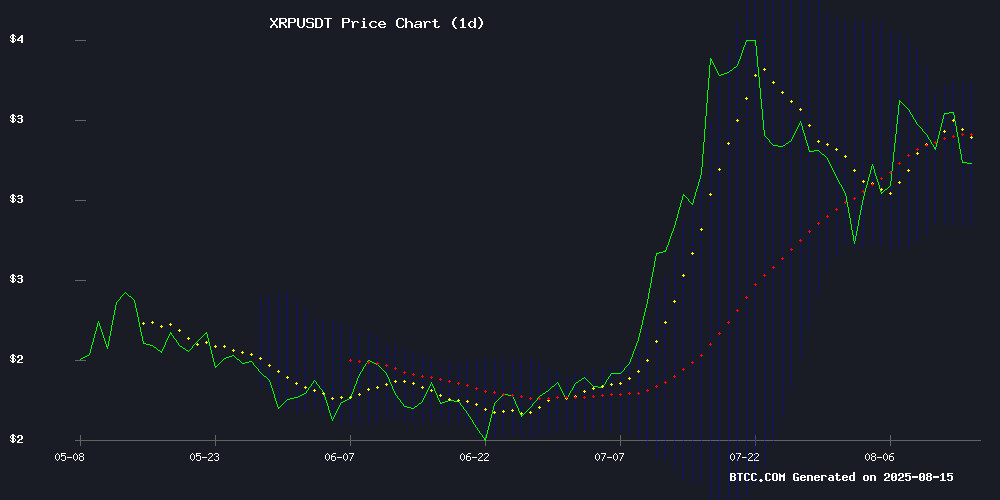

XRP is currently trading at $3.1156, slightly above its 20-day moving average of $3.1099, indicating a neutral to bullish bias. The MACD histogram remains negative (-0.0482), but the narrowing gap between the MACD line (0.0211) and signal line (0.0693) suggests weakening downward momentum. Bollinger Bands show price hovering NEAR the middle band, with potential resistance at $3.3835 (upper band) and support at $2.8363 (lower band).

"The technical setup shows XRP is consolidating after recent gains," said BTCC financial analyst Emma. "A sustained MOVE above the 20-day MA could open the path toward testing the $3.38 resistance level."

XRP Market Sentiment: Bullish Targets vs. Reality Checks

Market sentiment appears mixed as bullish price predictions ($3.60-$4.00 targets) contrast with cautionary notes about speculative hype. Positive developments like Ripple's growing institutional adoption and XRPL's maturation as financial infrastructure are being weighed against short-term volatility.

"While the bull flag formation suggests upside potential, traders should note the 6% pullback after breaking resistance," cautioned BTCC's Emma. "The $3.38 level remains key - a confirmed breakout could validate the $3.60+ targets, but failure may trigger profit-taking."

Factors Influencing XRP's Price

XRP Price Prediction: Bull Flag Formation Suggests $3.60-$4.00 Target by September 2025

XRP's recent 5.81% pullback to $3.13 belies a stronger technical setup, with analysts identifying a bull flag pattern that could propel the token toward $4.00 within weeks. The formation follows Ripple's legal resolution with the SEC, removing a key overhang for the asset.

Coinpedia's $4.00 target aligns with Bollinger Band resistance at $3.38, while Fibonacci levels suggest interim hurdles at $3.31. Market sentiment appears bifurcated—Finance Magnates cautions about profit-taking risks near $3.00, but the prevailing technical narrative favors upside.

Trading volumes remain elevated as the $2.84 support level holds. This consolidation resembles the 2021 setup that preceded XRP's 120% rally, though macroeconomic headwinds could delay the projected September breakout.

Expert Cautions XRP's $1000 Target as 'Speculative' Amid Global Payments Debate

XRP continues to dominate cryptocurrency discussions, fueled by ambitious price predictions ranging from $10 to $1000. Currently trading near $3, the token's potential hinges on its adoption as a global payments standard—a scenario supporters claim could propel its value "beyond all limits."

Manhar Garegrat, Country Head at Liminal Custody, tempers expectations. "The $1000 valuation chatter is more speculative than grounded," he told Coinpedia. "It would require a seismic shift in financial infrastructure. Not impossible, but improbable."

Ripple's technology faces skepticism about displacing SWIFT entirely. The ongoing SEC lawsuit and market volatility add layers of complexity to XRP's trajectory.

XRP Price Drops 6% Despite Breaking Key Resistance - Technical Analysis Points to $3.38 Retest

XRP trades at $3.09 after a 6% decline, yet bullish momentum remains intact following the SEC settlement breakthrough. The cryptocurrency initially surged on regulatory clarity but faced profit-taking pressures, leading to a 2% drop on August 12. Trading volumes remain elevated at $940 million on Binance spot markets, though institutional buying interest has cooled.

The SEC's landmark settlement with Ripple Labs, including a $125 million fine and an injunction on XRP sales to institutional investors, removed a major regulatory overhang. Technical indicators show neutral RSI at 50.22, suggesting potential for a retest of $3.38. Market participants await the next catalyst as volatility persists.

XRP Price Dips Despite ETF Optimism as Bulls and Bears Clash

XRP faces a 5% daily drop to $3.07 despite surging whale accumulation and ETF approval hopes, with analysts debating whether the token can reclaim its 2017 glory. Over 320 million XRP were scooped by large holders in three days as the market digests the SEC's recent closure of its Ripple lawsuit—a decade-long overhang that once stifled the asset's potential.

Technical indicators lean bullish after an 8% weekly gain, with trader Tony Severino projecting a $13 target based on historical patterns. The altcoin's $14 billion market cap expansion reflects shifting sentiment from caution to greed among both retail and institutional players.

Market dynamics now hinge on whether ETF optimism can override short-term profit-taking. The resolution of Ripple's legal battle has unlocked pent-up demand, echoing the 63,900% rally during XRP's 2017 bull run—but this time with regulatory clarity as tailwind.

XRP Price Prediction: Potential Breakout Above $3.66 Amid Market Volatility

XRP's recent 5% pullback aligns with broader crypto market weakness, but fundamental strengths suggest resilience. The token traded at $3.11 during reporting, down 4.49% on daily charts, yet maintains bullish potential toward $3.66.

Stablecoin adoption on XRP Ledger surged 46% weekly to $166 million, with Ripple's RLUSD dominating 50% of activity. This growth coincides with a 4% increase in XRPL's DeFi TVL to $89 million, reinforcing network utility.

Derivatives markets reflect confidence, with open interest climbing 9% to $8 billion. Macro tailwinds from softening US inflation and anticipated Fed rate cuts may further support upward momentum.

Ripple’s XRPL Emerges as Key Financial Infrastructure After 13 Years of Growth

Ripple CTO David Schwartz highlights the XRP Ledger's (XRPL) evolution into a cornerstone of global financial infrastructure. Over its 13-year history, XRPL has demonstrated resilience through continuous upgrades, institutional trust-building, and real-world adoption. Its permissionless design and low-cost interoperability position it as a competitive force in payments and stablecoin innovation.

Schwartz notes the growing trend of payment and stablecoin projects launching dedicated blockchains—a tacit acknowledgment of blockchain's role in modern finance. "Building an active ecosystem requires more than technology," he asserts. "Liquidity, developer engagement, and institutional confidence are earned through time and performance."

The ledger's battle-tested architecture contrasts with newer chains struggling to achieve network effects. XRPL's decade-plus of operation provides a unique advantage: proven stability during market cycles and regulatory scrutiny. This track record resonates with financial institutions seeking infrastructure capable of handling cross-border settlements and digital asset issuance.

Ripple CTO Debunks Myth of 35,000 Lost XRP, Clarifies Early Blockchain History

Ripple's Chief Technology Officer David Schwartz has addressed one of the most persistent myths surrounding XRP's origins—the claim that 35,000 tokens were permanently lost due to a technical bug. In an interview with Decrypt, Schwartz explained the rumor's origins, the reality of XRP's early development, and why no coins were actually destroyed.

Critics have long pointed to early blockchain records showing 534 transactions involving Ripple's initial 100 billion XRP supply, created in 2012. These transactions were misinterpreted as erasing a portion of circulating supply, casting doubt on the verifiability of Ripple's current holdings. Schwartz clarified that while some historical data from XRP's early days remains incomplete, this does not affect the current supply. All Ripple accounts remain publicly traceable on the ledger.

The technical reality is far less dramatic than the myth suggests. Though ownership details of some early wallets may not be publicly known, the provenance of all funds can still be tracked. At the time of the alleged "loss," Ripple maintained full control over its treasury—a fact now underscored by Schwartz's authoritative account.

Ripple CTO Debunks Myths Surrounding XRP's Early History

Ripple's Chief Technology Officer David Schwartz has dismissed long-standing rumors about lost XRP tokens, clarifying that no coins vanished due to technical issues. Early blockchain records showing 534 transactions from 2012 sparked speculation that part of the supply was irretrievable, but Schwartz emphasized these gaps don't affect current XRP accounting.

The CTO revealed Ripple controlled 99.9% of XRP's supply during the disputed period, making any alleged losses statistically insignificant. All historical transactions remain traceable on the public ledger, though some early wallet ownership details aren't publicly known.

Schwartz noted XRP had negligible value during its earliest development phase, contextualizing why transaction records from that era appear incomplete. The clarification comes as Ripple continues battling regulatory scrutiny and market skepticism about its tokenomics.

Ripple Exec Highlights XRP Ledger's Edge in Asset Tokenization

Ripple Senior Vice President Markus Infanger positions the XRP Ledger (XRPL) as a frontrunner in the next wave of real-world asset tokenization. Drawing parallels to the 1970s electronic shift in capital markets, he frames today's Special Purpose Vehicle (SPV) model as transitional scaffolding—centralized but necessary while infrastructure matures.

The endgame, according to Infanger, is native digital issuance where tokens become legal instruments and compliance is code-enforced. XRPL's protocol-level financial architecture allegedly reduces integration hurdles, offering atomic settlement and composable liquidity—features that could bypass today's clunky intermediary-dependent systems.

GENIUS Act Compliance Drives Innovation in XRP Cloud Mining Sector

The cryptocurrency landscape is undergoing a regulatory transformation with the implementation of the GENIUS Act, setting new standards for transparency and investor protection. Topnotch Crypto has seized this opportunity to launch the first fully compliant XRP cloud mining contracts, offering global investors a secure pathway to passive income.

By leveraging automated smart contracts and dynamic risk controls, the platform ensures real-time profit distribution and volatility protection. Third-party audits provide additional security layers, aligning with the GENIUS Act's rigorous requirements. This development marks a significant step in bridging decentralized finance with regulatory frameworks.

Singapore Emerges as Global Leader in Tokenized Finance and Blockchain Innovation

Singapore solidifies its position as a frontrunner in digital finance, leveraging blockchain technology to transform asset tokenization from experimental pilots to mainstream adoption. The city-state's regulatory-forward approach through initiatives like Project Guardian has created a fertile ground for institutional adoption.

Major financial players including HSBC, Euroclear, JPMorgan, and Citi are now actively participating in Singapore's Global Layer One (GL1) infrastructure program. This institutional embrace signals a pivotal shift from theoretical exploration to practical implementation of tokenized assets.

Ripple's APAC leadership highlights Singapore's unique position in advancing regulated finance through blockchain solutions. The ecosystem's maturation demonstrates how public blockchains can enhance accessibility, efficiency, and transparency in capital markets while maintaining rigorous compliance standards.

How High Will XRP Price Go?

Based on current technicals and market sentiment, XRP could see the following scenarios:

| Scenario | Price Target | Key Levels |

|---|---|---|

| Bullish Breakout | $3.60-$4.00 | Must hold above $3.38 resistance |

| Neutral Consolidation | $3.10-$3.38 | 20-day MA as support |

| Bearish Rejection | $2.83-$3.00 | Lower Bollinger Band defense |

"The $3.38 level is the linchpin," emphasized BTCC's Emma. "Institutional adoption through ETFs and Ripple's payments infrastructure growth provide fundamental support, but traders should watch Bitcoin's market correlation for broader crypto direction."

- Technical Convergence: Price hovering near 20-day MA with MACD showing potential reversal pattern

- Sentiment Drivers: ETF speculation vs. realistic institutional adoption timelines

- Macro Factors: Regulatory clarity and Bitcoin market correlation remain key influences